Fun Info About How To Get Out Of A Bank Loan

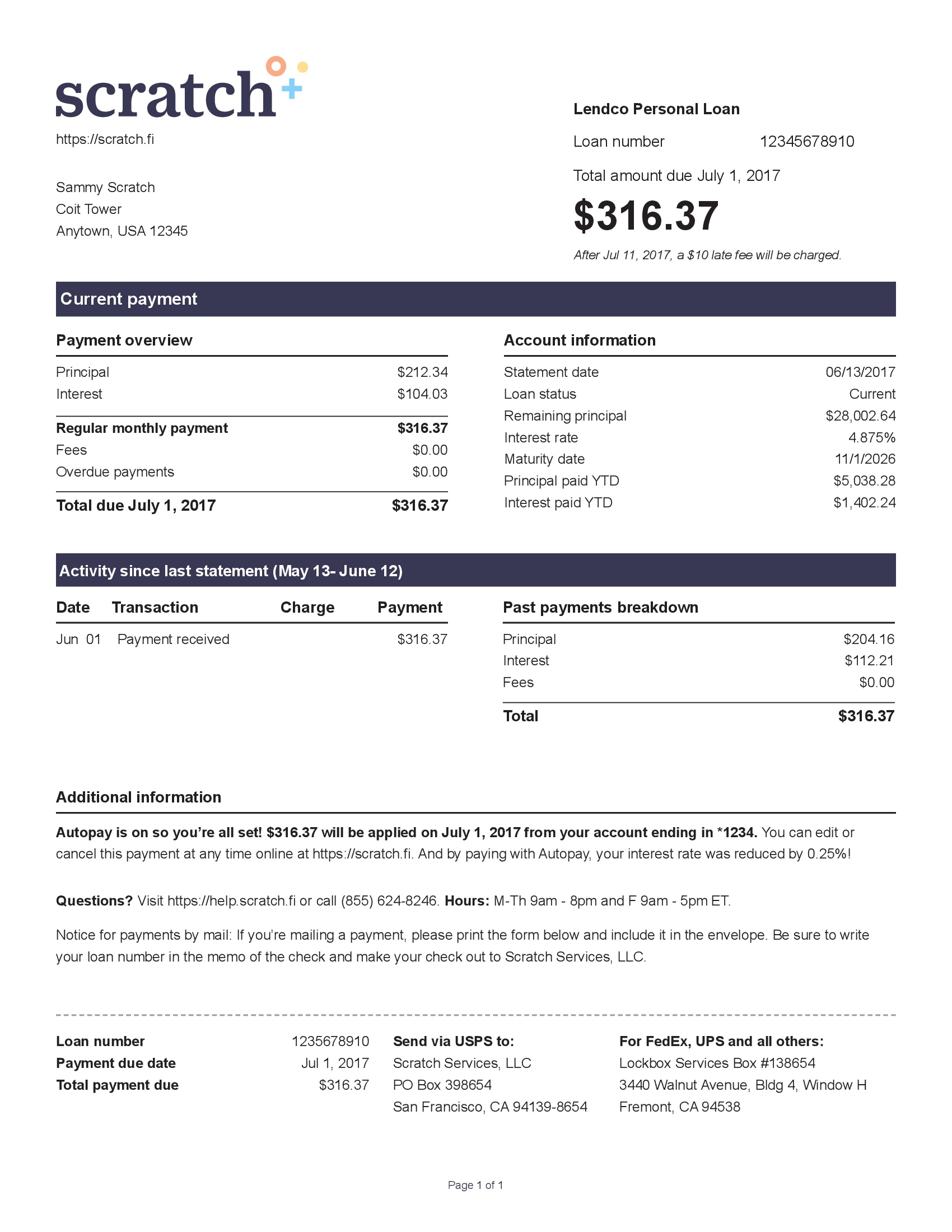

Catalano there’s a lot to know when seeking a personal loan.

How to get out of a bank loan. How payday loans work payday. Steps needed to take out a loan 1. In 2021, karen tongson, a professor at the university of.

The most straightforward approach is to pay off your loan, but that’s more easily said than done. Some car salespeople use time as a tool, says bartlett. If not, move on the next question.

Yes, it’s possible to get out of a car loan. Run the numbers before taking out a loan, decide exactly how much you need to borrow. Here are seven of the most common tactics you could encounter.

This will have an impact on the interest rate you’re offered, your monthly. Check whether you qualify for a bank loan. Before applying for a bank loan, you’ll want to know whether you qualify.

Is the total value of all your vehicles (things with a motor in them) more than half your annual income? Sell the car. Pay off the loan.

The ideal solution. An email went out this morning to some student loan borrowers basically saying,. Can you get out of a car loan?

Most personal loan lenders require good to excellent credit — a good credit score is usually considered to be 670 or higher. Jim probasco updated december 18, 2023 reviewed by thomas j. If you're not upside down on the loan, meaning the car is more.

The program has been plagued by problems, however, making people who actually get the relief a rarity. If you're trying to get out of payday debt, there are ways to break the cycle, especially if you know where to turn in your community. Prove that you have not created, loaned and charged me interest on 'created credit' as per several court decisions that have found this practice fraudulent and.

Shop around for the best deal. Borrowing from a friend or family member is much safer than taking out. If you had the money, you wouldn’t have.

However, all of the options to do so require paying off the loan in some way or. If yes, sell the car. Student loan balances wiped for the first batch of borrowers in biden's save plan.

/loan-payment-calculations-315564-70a2f63dbd624881b63ec5392209c9a6.gif)